www.gettheubervisacard.com – Apply for Uber Visa Credit Card

Uber Visa Credit Card

The pre-selected customers, who have received the pre-screened offer of credit from Barclays in their mail or email to apply for the Uber Visa Credit Card, can respond to that personalized offer and complete the application process online at www.gettheubervisacard.com. The recipients of the pre-screened offer can take advantage of the invitation before it expires through this safe and secure website 24/7.

The Uber Visa Credit Card pre-screened offer is provided to the consumers based on the information in their credit reports. One must meet all the pre-established credit and income criteria for this offer at the time of application. Otherwise, they may not be able to open an account to get an Uber Visa Card.

The offer is available for US residents, except Puerto Rico and the US territories, who are at least 18 years of age at the time of application. For details, review the materials you received along with the pre-screened offer. Uber Visa Credit Card is issued by Barclays Bank Delaware pursuant to a license from Visa USA Incorporated.

Uber Visa Credit Card Application

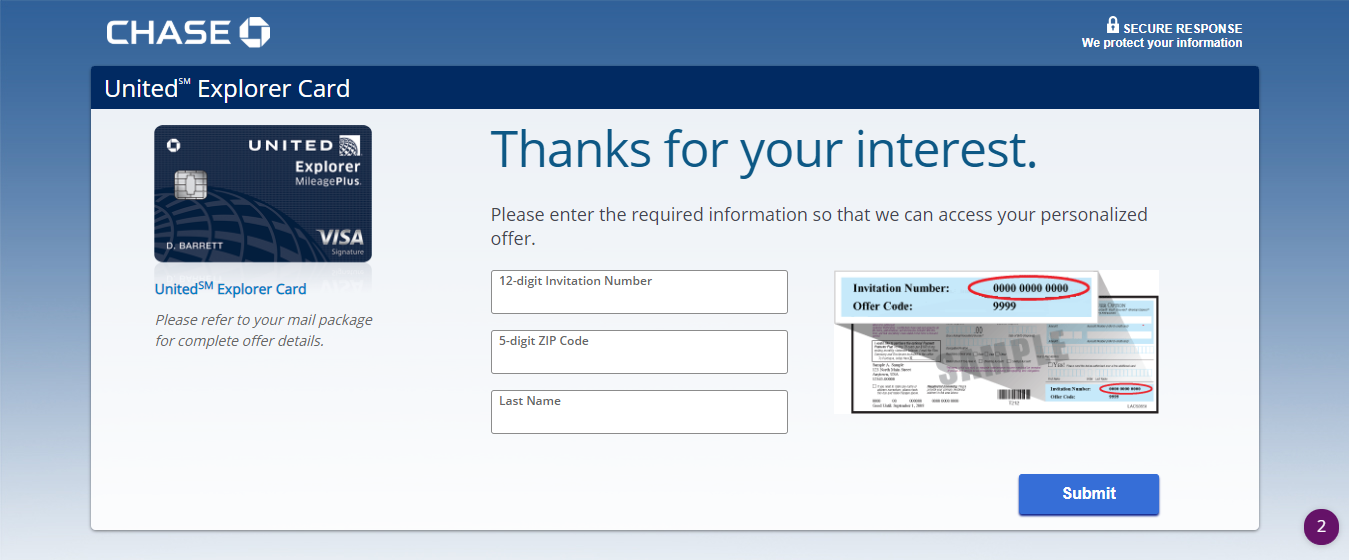

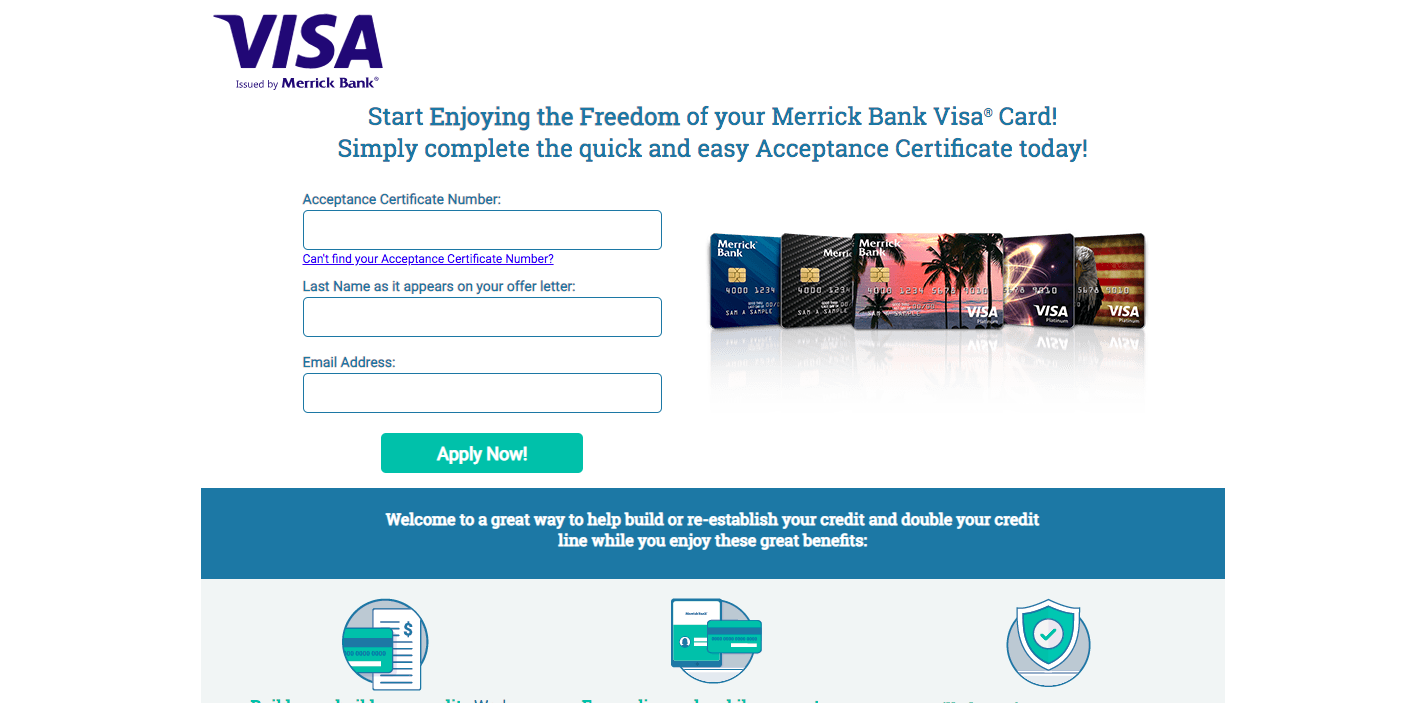

Applying online for Uber Visa Card with the Personal ID Code is considered the most convenient and easiest than other methods. However, to initiate the application keep the pre-screened offer letter ready and then you can follow the steps provided below.

- Go to the Uber Visa Credit Card page at gettheubervisacard.com

- Enter your Last Name exactly it appears on the offer you received in the first field located at the top of the page.

- Enter the 11 characters long Personal ID Code in the next blank space.

- Click the “APPLY NOW” button to proceed.

As a pre-screened member, some of the fields of the application form will be pre-filled with your information that will help you speed up the entire process. You can look at the following information that will require in the page of Barclays Uber Visa Credit Card application.

- Name

- Address

- Type of Residence

- Unit/Apt

- City

- State

- Zip Code

- Date of birth

- Mother’s maiden

- Email Address

- Social Security Number

- Annual Income

- Source of Income

- Phone number

- Balance transfer information

In addition to applicants may be asked for the country of citizenship or to show copies of identifying documents. To request the balance transfer you have to provide the 15 or 16 digits of the credit card that you want to process. Currently, Visa, Mastercard, Discover, and American Express are available for the balance transfer request at the time of application. Review ‘Terms and Condition’, to get the full details.

To check Application Status

After submitting the application, you can check the status of your Uber Visa Card application online. To do that, visit www.myapplicationstatus.com and enter the following information:

- Last Name

- Last 4 digits of your SSN

- ZIP Code

- And Email Address

Uber Visa Card Rewards Benefits

- Earn 4% back per dollar on Restaurant Purchases on dining at restaurants, takeout, bars, and UberEATS

- Earn 3% back per dollar on Travel Purchases on airfare, hotels, and vacation rentals including travel agencies and home share exchanges.

- Earn 2% back per dollar on Online Purchases including Uber, online shopping, video, and music streaming services

- And 1% back on all other Purchases

- Redeem points for Uber credits, e-gift cards or cash back.

Additional Benefits

- One-time 10,000 bonus points equal to $100 after spending $500 on net purchase using your new Uber Visa Credit Card within the first 90 days of account opening.

- Up to $50 Online Subscription Credits Anniversary benefits for spending on the card in a year.

- Up to $600 Mobile Phone Protection if you pay the mobile bills using your Uber Visa Card

- Exclusive access to select events and offers in select US cities

- No limits to the points you can earn and they will not expire as long as the program and your account will be

- No Foreign Transaction Fee

- No Annual Fee

Rates & Fees

- Purchase APR- 16.99%, 22.74% or 25.74%

- Balance Transfer APR- 16.99%, 22.74% or 25.74%

- Balance Transfer Fee- $10 or 3% of the amount on each transfer

- Cash Advance Fee- $10 or 3% of the amount on each cash advance

- Foreign Transaction Fee- 0%

- Late Payment Fee: Up to $37

- Returned Payment Fee: Up to $37

Contact Information

Mail Application Address:

PO Box 8801, Wilmington, DE 19899-8801

For Phone Application, dial 866-255-9725

To check application status or ask any other question related to your application, call 866-823-7543

References: