www.wellsfargo.com – Wells Fargo Secured Credit Card Application

Wells Fargo Credit Card is one of the best-secured credit cards in markets and it offers the users a good chance to build or rebuild their credit at a low cost. As a secured credit card Wells Fargo requires the cardholders to deposit a security amount of credit, minimum $300, which also defines their credit line.

The Wells Fargo Secured Credit Card is not among the cheapest cards, but it is also not as expensive as other secured card. And it offers almost the same features as other credit cards e.g. Walmart Credit Card, Tire Plus Credit Card, Paypal Credit Card etc. although it is a secured card.

Wells Fargo Secured Credit Card is issued by Wells Fargo bank. The card can be used at any location where Visa Credit Card is accepted.

Wells Fargo Secured Credit Card Features and Benefits

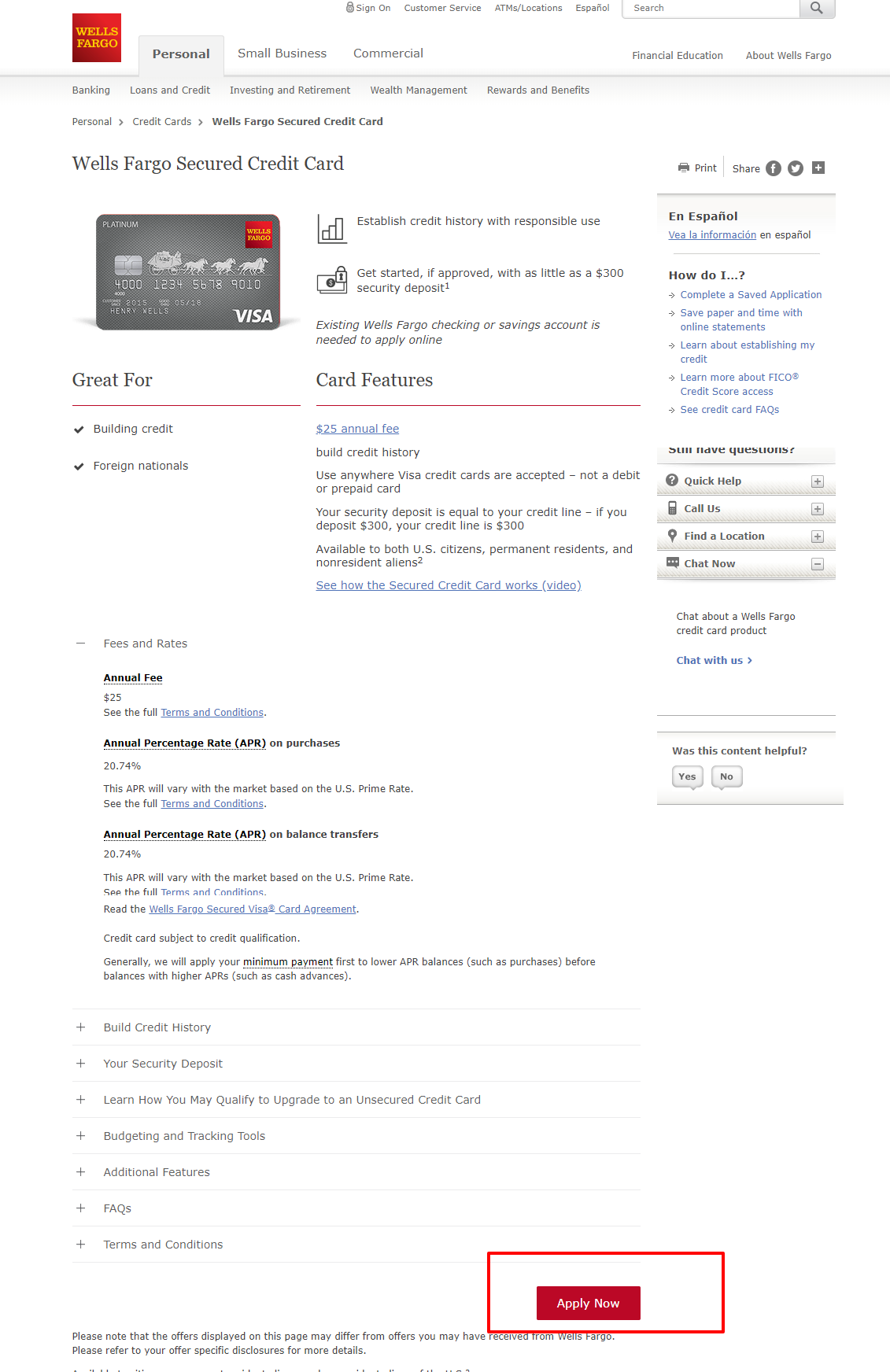

- There is an annual fee of $25

- Cardholders need to deposit $300 up to $10,000 as a security. This amount of money forms the base of your credit limit also. If you want to increase your credit line, you can add the security deposit.

- You are not allowed to access the security deposit that will be held in a separate, non-interest bearing collateral account and doesn’t change over the time until the account is closed or upgraded.

- You can share your card activity with major credit bureaus to build a good credit history for you.

- The card is for both US permanent residents and nonresidential aliens.

- Users have the option of online access to their accounts unlimited, the automatic payments and purchase alerts

- Users can make payments through their mobiles using Apple Pay, Android Pay, and Samsung Pay.

- Zero Fraud liability as your account will be safe by rapid alerts and verified access powered by Visa.

Apart from these, the cardholders will enjoy some other benefits i.e. auto rental collision damage waiver, emergency card replacement, travel and emergency assistance services, roadside dispatch, cell phone protection.

Rates and Charges

- Annual APR for purchases- 20.49%

- APR for Balance Transfer- 20.49%

- APR for Cash and Overdraft Protection Advances- 25.49%

- No interest charge if you pay in 25 days

Fees

- Annual Fee- $25

- Foreign Transaction Fee- 3%

- Balance Transfer Fee- $5 to 5%

- Cash Advance Fee- $10 or 5%

- Overdraft Protection Fee- $12.50-$20

- Penalty Fee for late payment and returned check- up to $37

Wells Fargo Secured Credit Card Application

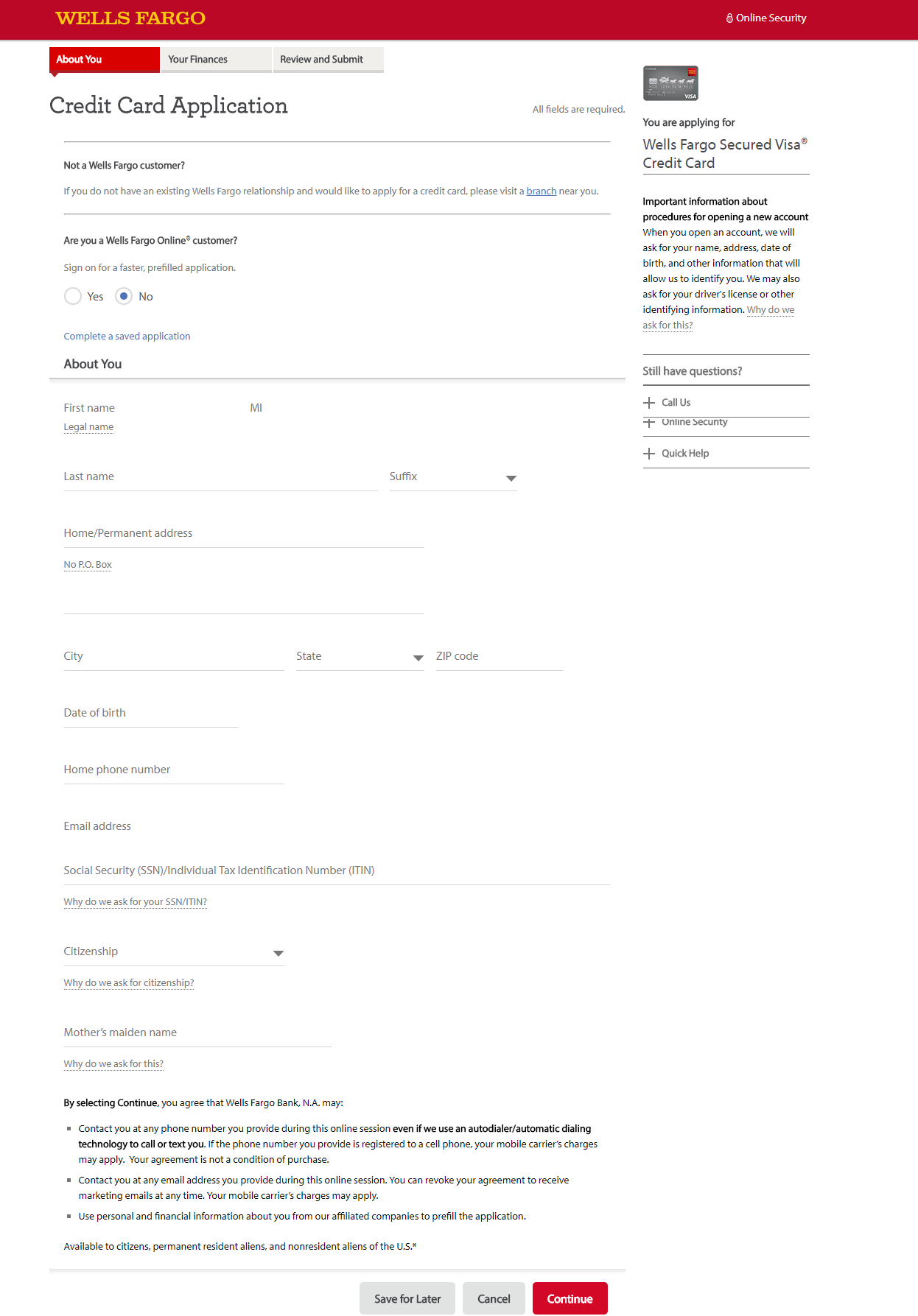

The online Wells Fargo Secured Credit Card application is only available for Wells Fargo customers. If you are not, visit the nearest Wells Fargo branch.

- To begin the application procedure visit Wells Fargo Secured Credit Card official website at https://www.wellsfargo.com/credit-cards/secured/

- Click the “Apply Now” button and fill the form entering the required information such as Name, Permanent Address, City, State, Zip Code, Date of Birth, Phone, Email Address, Social Security Number (SSN) or Individual Tax Identification Number, Citizenship and Mother’s Maiden Name.

- Press “continue” and provide the required financial details.

- Check the terms and conditions and accept

- Review The entire application once again and “Submit”.

If you are approved, a mail package with necessary information will be mailed to you. If not approved, you will receive an explanation letter showing the causes.

Contact Details

The customer service numbers are open 24 hours 7 days a week.

For general queries- 1-800-642-4720

To check online application status- 1-800-967-9521

To apply by phone- 1-800-932-6736

Mailing Address

Wells Fargo Card Services

P.O. Box 10347

Des Moines, IA 50306-0347