banking.westpac.com.au – Manage your Westpac Credit Card Online

Westpac Credit Card Account:

As Australia’s first and oldest bank, the Westpac Banking Group has a long and prideful history. It was set up in 1817 as the Bank of New South Wales under a sanction of consolidation given by the Governor Mr. Lachlan Macquarie. The Bank has changed its name in October 1982 to Westpac Banking Corporation by following the possession of the Commercial Bank of Australia. At that point of time when they started operating their business the first employee was Joseph Hyde Potts, a servant, and porter, who used to get weekly ration from the King’s stores and a yearly compensation of 25 pounds.

During the period, from 1993 to 1999, under the prominent leadership of Mr. Robert (Bob) Joss, the Westpac Group went through a generous restoration program. And later on actuated various acquisitions in Australia and New Zealand business market like obtaining Challenge Bank Limited, in Western Australia in 1995, the Trust Bank of New Zealand in 1996, and the Bank of Melbourne, Australia in 1997 to extend its retail impression in business sectors where it was underweight till that period.

Westpac started the new 20th century as a chief sponsor of the exceptionally effective Sydney 2000 Olympic Games. In the year 2002, the bank started a vital strategic reshaping beginning with the sale of its longstanding notable money organization, Australian Guarantee Corporation Limited (AGC) to GE Australia.

In the year 2008, Westpac converged themselves with St. George Bank Limited, forming a lot bigger Multi-Brand Group in the market. The successful date of the consolidation was 1st December 2008. In March 2010, The Westpac Group initiated working as a solitary approved deposit-taking institution (ADI), and the lawful existence of St. George Bank Limited was unregistered. Since then, the St. George Bank turned into a working division inside The Westpac Group. In July 2011, the Westpac Group launched the Bank of Melbourne through its working division, St. George Banking Group.

The purpose of Westpac Group is to help the Australian people to succeed. It’s the main event, what their identity is, and why they come to work each day. The most important thing to them is understanding how achievement affects their clients and assisting them with getting it. By building a deep and trustworthy customer relationship, primarily their basic strategy seeks to focus on this purpose. The group also focuses on delivering better returns for shareholders and being a leader within the community, and a workplace where the best people in the market want to work.

By following their methodology, they are well focused on the core business sectors of Australia and New Zealand, where they provide an exhaustive scope of monetary products and services that help them in gathering the financial services required by the clients. Westpac Group’s with its solid foundation in these business sectors and with more than 13 million clients, our emphasis is on natural development, increasing client numbers in their chosen sectors, and building more grounded and more profound relationships.

How to Activate a Westpac Bank Credit Card :

To Activate a Westpac Bank Credit Card, you need to register yourself first, then Sign-In in into your account, after that go to the Credit Card category, choose your card (the card you have already applied for), under that card you will find the “Activation” option.

Activation through Phone:

You can also activate your Westpac Bank Credit Card, over the telephone. You just need to call the Customer Care Service at 1300 -308 -930 for further guidance.

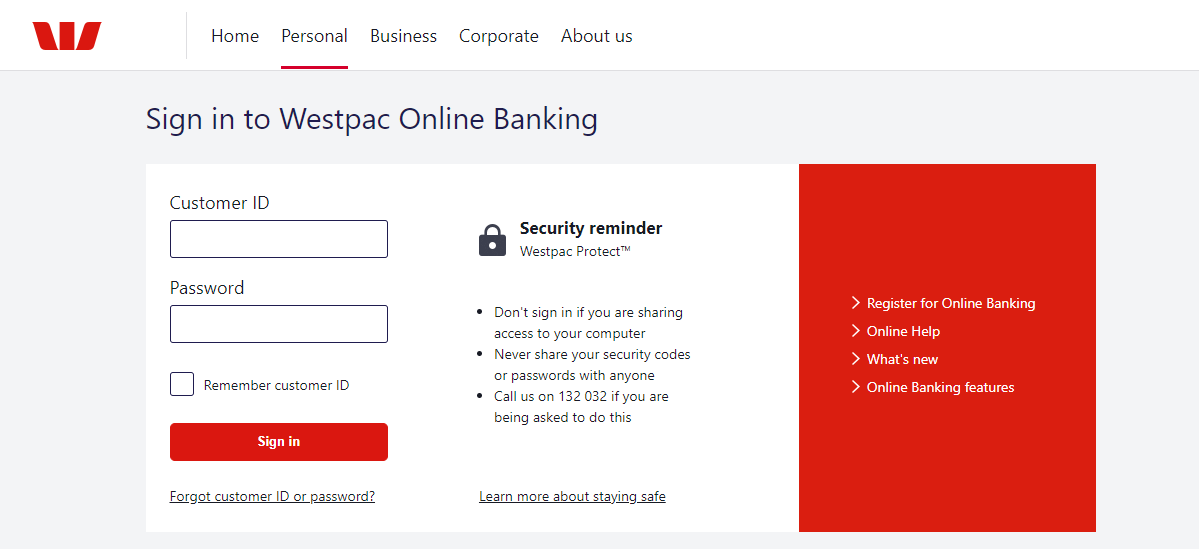

How to Log In or Sign In for the Westpac Bank Credit Card :

To Log In for the Westpac Bank Credit Card, you need to follow the below guidelines:

- Visit the main official website of the Westpac Bank.

- You can also tap on the link provided www.westpac.com.au.

- On the landing page of the website, tap on the “Sign In” bar on the above top corner, or go to banking.westpac.com.au page.

- Deferred on a new page, put down your “Customer ID” and “Password”.

- Now by pressing the “Sign In” bar below, you can get into your account.

How to get Register for the Westpac Bank Credit Card :

To get Registered for the Westpac Bank Credit Card, follow the simple instructions below stated:

- Go to the authoritative website of Westpac Bank or, click on www.westpac.com.au

- On the landing page, find and tap on the “REGISTER”

- Then click on the “Westpac Live – Personal”

- On the next webpage by tapping on the “Register Now” bar, again you will be referred to another page.

- Here, under the “PERSONAL DETAILS” heading, you will find 2 (two) options, like “Card Number” and “Customer ID”.

- Now under the “Card Number” option, put your Westpac Credit Card Number, First Name, Last Name, Date of Birth (Select your DOB), etc, and press the “Next”

- And under the “Customer ID” option, you also need to put down your Westpac Bank Customer ID (You can find your Customer ID on the first page of your Statement), First Name, Last Name, Date of Birth (Select your DOB), etc and press the “Next”

- In both cases, after tapping on the “NEXT” tab you need to follow the on-screen instructions to get registered.

Please Note: In any case, if you feel any difficulty during the registration process, you can call Westpac Customer Helpline Number at – 1300 -655 -505 (8 am to 8 pm, 7 days a week). You can also use the Westpac Mobile application to get register.

Also Read : How to Activate Luma Credit Card Online

How to Apply for the Westpac Bank Credit Card :

To Apply for the Westpac Bank Credit Card, follow the simple steps:

- On the main landing page of the website, choose the “PERSONAL” option and tap.

- Then by tapping on the “Credit Card” option, you will be on the Credit Card page.

- Here on the Credit Card page, you have to choose your card as per your requirement and Apply.

Various Credit Cards offered by the Westpac Bank

Presently the bank is offering Credit Cards under 4 (four) categories. Those are:

- Reward Credit Cards

- Low Rate Credit Cards

- Low Annual Fees Credit Cards

WESTPAC BANK REWARD CREDIT CARDS :

Altitude Rewards Platinum Credit Card

Benefits:

- To apply for the card the minimum income requirement is $30,000 annually.

- Your minimum Credit limit will be $6,000.

- Get 3 Reward Points on spending $1 on Jetstar and Qantas flights brought in Australia.

- Avail 2 Reward Points for $1 spent on Uber Eats, Uber Ride, Spotify Premium, Airbnb, and on Foreign Spends including foreign purchases made from Australia.

- And get 1 Reward Point for other eligible purchases.

- You can earn 80,000 Bonus Altitude points for a minimum spend of $3k.

Rates and Interests:

- Annual Fees – $99 for the first year, afterward $150 will be applied.

- Balance Transfer Fees – 0% annually for the first 18 (eighteen) months.

- Annual Altitude Reward Program Fees – $0 (No Fees).

- Variable Purchase Rate – 20.49% annually.

Altitude Rewards Black Credit Card :

Benefits:

- The minimum income requirement is $75,000 to apply.

- Your minimum Credit limit will be $15,000.

- Get 6 Reward Points for spending $1 on Singapore, Emirates, Jetstar, and Qantas Airlines brought in Australia.

- Avail of 2 Reward Points for spending $1 David Jones, Spotify Premium, Airbnb, Myer, THE ICONIC, Uber and on Uber Eats, etc.

- And get 1.25 Reward Points for other eligible purchases.

- You can earn 1,50,000 Bonus Altitude points for a minimum spend of $4k.

Rates and Interests:

- Annual Fees – $250 for ongoing Annual Card Fee.

- Balance Transfer Fees – 0% annually for the first 18 (eighteen) months.

- Annual Altitude Reward Program Fees – $0 (No Fees).

- Variable Purchase Rate – 20.49% annually.

Altitude Qantas Platinum Credit Card :

Benefits and Rates:

- All Benefits and rates are the same as Altitude Reward Platinum Card.

- Except, you can earn only 0.5 Reward Points on per $1 spent for other eligible purchases.

- You can earn 60,000 Bonus Qantas Points for a minimum spend of $3k.

- And you will be charged with $50 for the Annual Altitude Qantas Program Fee.

Altitude Qantas Black Credit Card

Benefits and Rates:

- All Benefits and Rates are the same as Altitude Reward Black Card.

- Except, you can earn only 0.75 Reward Points on per $1 spent on other eligible purchases.

- You can earn 1,20,000 Bonus Qantas Points for a minimum spend of $4k.

- And you will be charged with $50 for the Annual Altitude Qantas Program Fee.

Altitude Velocity Platinum Credit Card

Benefits and Rates:

- All Benefits and Rates are applied the same as Altitude Qantas Platinum Credit Card.

Altitude Velocity Black Credit Card

Benefits and Rates:

- All Benefits and Rates are applied the same as Altitude Qantas Black Credit Card.

WESTPAC BANK LOW RATES CREDIT CARDS

Westpac Low Rate Credit Card

Benefits:

- The minimum Credit limit approval is $500.

Rates and Interests:

- Annual Card Fees – $59

- Variable Purchase Rate – 13.74% annually.

- Interest Fee on Purchases – Free ($0) up to 55 days.

- Balance Transfer Rate – 0% annually for 28 Months. Additionally get a first year fee waiver, saving you $59).

Westpac Lite Credit Card

Benefits:

- The minimum Credit limit approval is $500.

Rates and Interests:

- Annual Card Fees – $108 annually and $9 on monthly basis.

- Variable Purchase Rate – 9.90% annually.

- Interest Fee on Purchases – Free ($0) up to 45 days.

- Foreign transaction Fees – Zero ($0) fees including your Online Shopping.

WESTPAC BANK LOW ANNUAL FEES CREDIT CARDS

Westpac Low Fee Credit Card

Benefits:

- The minimum Credit limit approval is $500.

Rates and Interests:

- Annual Card Fees – $0 (No Fee) applicable only for the first year.

- Ongoing Annual Card Fees – $30 (For spending $5k annually fees will be $0)

- Variable Purchase Rate – 20.09% annually.

- Interest Fee on Purchases – Free ($0) up to 55 days. Get a Welcome, of offer 0% charges annually for 15 (fifteen) months from the date of card approval.

Westpac Low Fee Platinum Credit Card

Benefits:

- The minimum Credit limit approval is $6,000.

- Get the benefit of complimentary Insurance Coverage with this credit card.

Rates and Interests:

- Annual Card Fees – $0 (No Fee) applicable only for the first year.

- Ongoing Annual Card Fees – $90 (For spending $10k annually fees will be $0)

- Variable Purchase Rate – 20.09% annually.

- Interest Fee on Purchases – Free ($0) up to 55 days.

Contact Details:

Westpac Group (Head Office Address)

275 Kent Street,

Sydney, NSW 2000, Australia

Head Office Phone Number (Call): 132 -032 (For Within Australia)

Head Office Phone Number (Call): (+61 -2) -9155 -7700 (For Outside Australia)

Phone Numbers:

Customer Care Card Centre (Call): 1300 -651 -089 (For Within Australia) (24 X 7)

Customer Care Card Centre (Call): +61 -2 -9155 -7700 (For Outside Australia) (24 X 7)

For Lost or Stolen Credit Card (Call): 000 (To Police) or 131 -444 (Police Help Line)

For Fraudulent Transaction (Call): 1300 -651 -089 (For Within Australia) (24 X 7)

For Fraudulent Transaction (Call): +61 -2 -9155 -7700 (For Outside Australia) (24 X 7)

For Registration Process (Call): 1300 -655 -505 (8 am to 8 pm, 7 days a week)

For Credit Card Activation Over Phone (Call): 1300 -308 -930

Reference Link:

www.westpac.com.au/personal-banking/credit-cards