www.luma.co.uk – How to Activate Luma Credit Card Online

How to Log In or Sign In for the Luma Credit Card:

To Log In or Sign In for the Luma Credit Card, go with the below guidelines:

- Visit the authoritative website of the Luma Credit Card.

- You can also click on the link provided www.luma.co.uk.

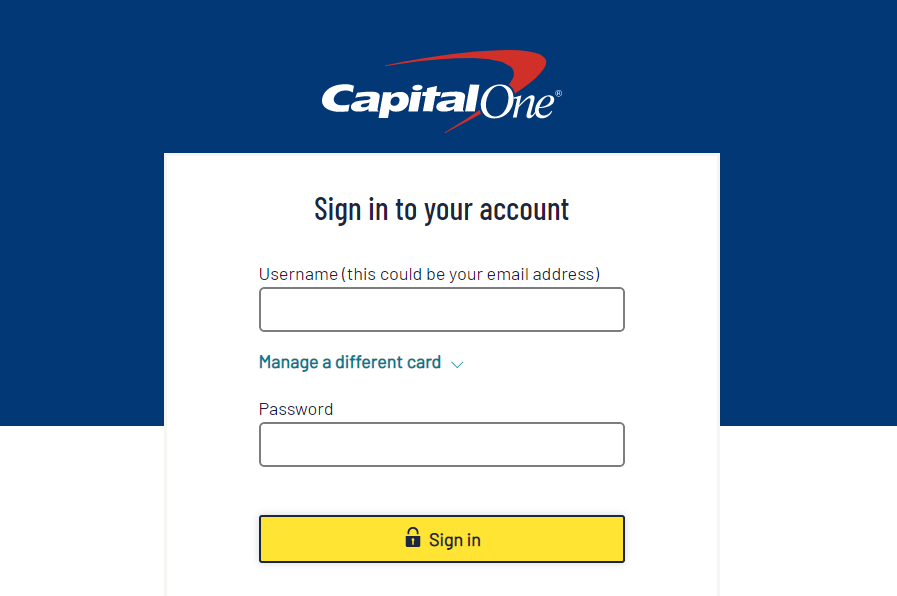

- On the landing page of the website, you will find and tap on the “Sign In”, or go to the myaccount.capitalone.co.uk/login page.

- Now on the Capital One Sign In page, enter your “Username” and “Password” as required.

- Then by tapping on the “SIGN IN” button below, you get the access to your account.

How to Reset or Forgot your Password for the Luma Credit Card:

To Reset or Forgot your Password for the Luma Credit Card, you have to go to the Capital One Sign In page following the Sign In process. Here you will find the “I’ve forgotten my Password” link, by tapping on the link you will be on another page. Here you have to put your “Username” (this can be your Username), now press the “Continue” button below and follow the on-screen process to complete.

All about Luma Credit Card:

You have to manage and control your Luma Credit Card very sensibly, make your payments on or before due time and try to stay within your credit limit and you could improve your credit rating with time. Moreover, failing to control & manage your Credit Card sensibly could harm your credit rating score.

Benefits and Advantages:

- Before you apply for the Luma Credit Card, know your acceptability and eligibility with the Quick Check method on the official website.

- With No Annual Fee, the Luma Credit Card is a good choice for your credit building score.

- While applying for the card you will get a response within few seconds.

- Take the advantage of getting a Credit Card, even if you are new or first-time to credit, and if you have got a Country Court Judgement (CCJ) or other issues regarding your credit rating.

- Access your account at your convenience anytime, anywhere, with the help of Online Account Management and Luma Credit Card Mobile Application.

- You can also add additional cardholders, to your account and streamline your regular household’s finances and manage and track your overall expenditure, utilizing the Luma Card. But always remember, you are solely liable for all transactions on your account.

- The cards are always easy to manage, with a Credit limit of up to £1500, (depending on your creditworthiness).

- There are no nasty surprises, along with No Annual Fee, and no hidden charges for using the Luma Credit Card.

- Free identity (ID) theft protection along with automated fraud alerts always ensures you that your account always stays digitally safe and secured and you get the help & support when you need it the most.

- You always get the guidance for utilizing the Luma Credit Card wisely and responsibly, understand how to build your credit while improving your credit score rating.

Also Read : Activate your Opal Card Online

It does not matter where you are, or what’s the time of day, it’s secure, simple, and easy to manage and keep track of your finances & Luma Account Online. After you get registered online as a verified and eligible Luma Credit Cardholder, you can now:

- Watch your accounts statements anywhere, anytime, and get Email alerts.

- You can make payment of your bills online and also can update your account fast and easily.

- Have the benefit of reducing your paperwork with electronic documents.

- Take the facility of transferring your balance easily, view your PIN, and chance it safely when required.

Luma Credit Card – An Introduction

The Luma Credit Card is issued and approved by the Capital One (Europe) plc, enlisted in the United Kingdom. The make an application for the Luma Credit Card is simple and clients can get a response within few seconds. The Credit Card offers a credit limit point of up to £1,500.

There are a huge number of individuals who utilize the Luma Credit Card consistently to make payments for their everyday products along with entertainment like a holiday tour, making advances for a car, dining out, etc. The main reason behind why such countless individuals use Luma Credit Cards is that it is simpler to carry around and it’s digitally safer, to make payments in emergency situations and presently most places acknowledge the Credit Cards for their simplest utilization.

In any case, if you have an unexpected bill or simply you just need to purchase something and you don’t have the funds ready with you, credit cards come in incredibly valuable. Although it’s not always a smart move to utilize your credit card as the only way to make out your payments all the time, you should always remember that you have to pay it back later. That’s why it is always recommended to use your credit card wisely.

Every time you should be cautious about your decision when you take out your Luma Credit Card, or any Credit Card, for payment, and it also shows up how good are you about your budgeting. For instance, if you are a youngster and leaving in a University hostel and looking for some independence, you might be stressed over how you will manage, financially for everyday costs you’ll have to live, then a credit card may be a good solution for you.

How to Activate a Luma Credit Card:

Activate through Online:

If you are willing to Activate a Luma Credit Card, you must be Logged in to your account of Luma Credit Card, on the official website. Then search for the activation option, and on the webpage, you have to put your Credit Card Number, Your Full Name, Safety Code Number (Find it on the backside of your card), and lastly, tap on the Submit button below. You will be informed after your card is activated.

Activate through Telephone:

If you face any problem regarding the online activation, you can still activate the card via your smartphone. You have to call the Luma Credit Card Customer Care Services numbers at 0333 -000 -0477 (Within UK) or +44 -333 -0000 -433 (Outside UK) to reach the automated telephonic guidance and put your Luma Credit Card Number or Card Safety Code. It’s simple, quick, and convenient.

Rates and Interests:

- Representative APR – 35.9% (Variable)

- Monthly Purchase Rate – 2.59%

- Annual Monthly Rate – 35.94%

- Monthly Cash Withdrawal Rate – 2.59%

- Annual Cash Withdrawal Rate – 35.94%

- Monthly Balance & Money Transfers – 2.59%

- Annual Balance & Money Transfers – 35.94%

- Interest-free Period for Purchase – A period of a maximum of 56 days is permitted for purchase, in case the balance payment is made in full within the due date.

- Interest-free Period for Balance / Cash & Money Transfers – Zero (0) days

- Credit Limit – Minimum £200 to £1,500 Maximum

- Handling Fees for Balance & Money Transfer – 3.0%

- Cash Fee (Including Gambling Transactions) – 3.0% (Minimum £3)

- Non – Sterling Transaction Fee – 2.75%

- Late & Failure Fee for paying Default Sum – £12 (For paying late or not paying at all)

- Over the limit of Default Sum Fee – £12 (For going over the Credit Limit)

Please Note: A simple rate of 31.10% interest rate is charged for Purchases, Balance & Money Transfers, and Cash Withdrawals, from the date of this Agreement.

Contact Details:

Capital One Card Services

P.O. Box 5283

Nottingham

NG2 9HD

If you want to send us a Cheque Payment, Please post it to:

Capital One Europe Plc,

PO Box 1517, NORTHAMPTON, NN1 9GZ

Phone Numbers:

Apply for a Payment Holiday (Call): 03444 -812 -812 (In case you have being affected by the Corona Virus)

General Account Inquiry (Call): 0333 -000 -0477 (Local) and +44 -333 -0000 -433 (Outside UK)

Online Account Inquiry (Call): 03444 -814 -000

Report for Lost or Stolen Card (Call): 0800 -597 -0178 (Local) and +44 -333 -0000 -433 (Outside UK)

Report Fraud (Call): 0800 -597 -0178 (Account Fraud) and 0344 -481 -2812 (Application Fraud) (Monday to Friday 8 am to 9 pm and Saturday and Sunday 8 am to 5 pm)

For Payment Support (Call): 0800 -952 -4966 (Monday to Friday 8 am to 9 pm and Saturday and Sunday 8 am to 5 pm)

Existing Application and Extra Cardholders (Call): 0800 -597 -0065

For further Inquiry (Call): 0344 -481 -4814 (To directly talk to a Customer Care Executive) (Monday to Friday 7 am to 9 pm, and Saturday and Sunday 8 am to 5 pm)

Clients who are Deaf or Hard of Hearing & utilizing a Text Phone, or the Relay UK Application (Developed by Relay UK & it’s free to download) on a compatible internet-connected device, can Contact the Luma Credit Card through the Relay UK (Previously known as Type-talk / Text Relay / Next Generation Text) on the below-given phone numbers:

Timings are: (Monday to Friday 8 am to 9 pm and Saturday & Sunday 8 am to 5 pm)

General Account Inquiry or Report Lost or Stolen (Call): 18001 -03440-481 -8852

Report Suspected fraud on Account (Call): 18001 -0800 -952 -5066

Required help for Problems with Payments (Call): 18001 -0800 -952 -5071

Reference Link:

myaccount.capitalone.co.uk/login