Cerulean Credit Card Login at ceruleancardinfo.com

About Cerulean Credit Card

Continental Finance provides the Cerulean Mastercard Credit Card members a safe and secure web portal to access and manage their card account online. Using this online platform they can register their newly received Cerulean MasterCard and sign into the online card account. This is a free service provided to you as a feature of your credit card.

After logging in the Cerulean Credit Card account, users can access all the online banking service such as pay the credit card bills, view balance, recent transactions, previous statements, payment history, sign up for e-statement and more. The Cerulean Credit Card is issued by The Bank of Missouri and serviced by Continental Finance Company.

The cerulean credit card is a card from Continental Finance. This is a MasterCard, and it’s best for people with poor credit. This is also an invitation-only credit card, which means you can apply for the card with a pre-qualification offer. In this article, we are going to discuss Cerulean credit card login and bill payment. Read on to know more.

Benefits of Cerulean Credit Card

- No Maintenance Fee– The card has an annual fee, but they don’t have a maintenance fee.

- Reports to Major Credit Bureaus– Continental Finance reports to the major credit bureaus. This will help you build a good credit history if you were running with a poor one previously.

- Free Account Access– You can access your account online whenever you want and it’s free.

- Accepted Almost Everywhere– this is a MasterCard, and that is the reason you can use this card almost everywhere.

- Free Credit Scores– you can avail free credit scores once you become a cardholder.

Features of Cerulean Credit Card

- No monthly maintenance fees for the card

- Initial credit limit starts from $300.00 to $1,000.00

- Quick and easy application process. You will get the results in seconds.

Rates of Cerulean Credit Card

- APR on purchases is 24.99% to 25.9%

- Cash advance fee is 5%

- Cash advance APR is 24.99% to 25.9%

- Foreign transaction fee is 3%

- Max late fee is $41

- Grace period is for 25 days

- Annual fee is $120

How to Apply for Cerulean Credit Card

- You can apply for the card if you have received an invitation from the company.

- If you have the invitation code, you can apply for the card by calling on a designated number.

- Call on 1-866-513-4598.

- Once you connect with the call, provide the code and other required details.

Register for Cerulean Credit Card Account

To use the Cerulean Mastercard the new cardholders need to register it first and set up online card account. For the registration process, you can follow the steps right below:

- To get registered with the Cerulean credit card online account go to the website www.ceruleancardinfo.com

- Secondly at the upper right side of the page click on “Login” option to access the sign in section.

- Under the login spaces click on “Register for account” option to get started.

- Provide the last 4 digits of the account, last 4 numbers of SSN, and the billing zip code.

- Now click on “Next” to verify further and complete the registration.

How to Activate Cerulean Credit Card

- To activate Cerulean credit card go to the web address www.ceruleancardinfo.com

- Next at the top right side of the page click on “Activate my card” option to start the process.

- Enter the last 4 digits of the credit card, last 4 digits of SSN, the 5 digit zip code and click on “Activate my card” option to activate the credit card.

Cerulean Credit Card Login

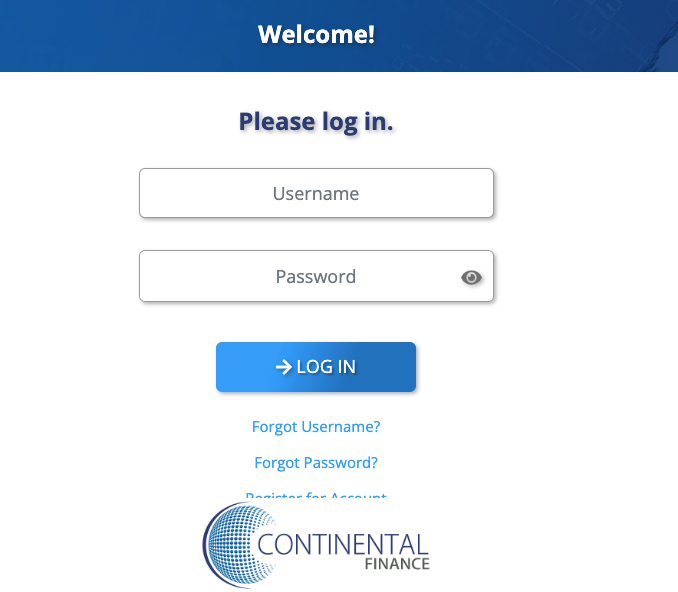

After you complete the registration and signed up for online account access, you can access or manage the card activity by logging into your Cerulean Mastercard account online.

- To get logged in use the link www.ceruleancardinfo.com

- Next at the upper right side of the page click on “Login” option to access the sign in section.

- Add the username, password and click on “Log in” option to get signed in.

Recover Cerulean Credit Card Login Details

- If you can’t remember the Cerulean credit card login details go to the webpage com

- Next at the upper right side of the page click on “Login” option to access the next step.

- Under the login spaces click on “Forgot username?” option to start the process.

- Enter the last 4 digits of the account, last 4 numbers of SSN, and the billing zip code.

- Click on “Find account” to reset the username.

- To retrieve the password click on “Forgot password?”

- Provide the username and click on “Find account” to reset the password.

Cerulean Credit Card Bill Payment

Cerulean Credit Card bill payment has various option. You can pay using your credit or debit card, and attach your account for an online payment. You will get bill payment options like, online, phone and through mail. Let’s know about the options individually.

Make Cerulean Credit Card Payment Online

There are many ways to pay your monthly Cerulean Credit Card bills. The most convenient and easiest option is online. For that, log into your card account and go to the payment section. Now pay the bill amount from your bank checking account through electronic debit providing the required details.

You can also set up AutoPay by selecting a payment source and the amount for the automatic monthly payment. The payment will be automatically deducted from your chosen account on the scheduled date each month.

Cerulean Credit Card Bill Pay by Phone

- You must have the payment initials, your card and pay the bill.

- You have to call on 1-800-518-6142.

Pay Cerulean Credit Card Bill by Mail

- You can also pay the bill through mail. You have to send a money order or a check. Mention your name, account number, and the amount.

- Send it to- Cerulean Card. P.O. Box 6812. Carol Stream, IL 60197-6812.

Cerulean Credit Card Bill Pay by Payment Services

- You can make the payment through Western Union.

- Use Code City- GOFORGOLD.

- For MoneyGram- Receive Code- 5854.

Cerulean Credit Card Contact Help

If you are having Cerulean Credit Card login trouble, you can contact the customer support team. Once you contact them, the team will help you resolve the issues.

Let’s take a look at the contact information

- Contact Number- 1-866-513-4598

- Contact Number- 1-866-449-4514

FAQs about Cerulean Credit Card

Are Cerulean and The Surge Card the Same?

Surge credit card is also from Continental Finance, and it’s almost similar to the Cerulean card. Surge card has the same double your credit in six months and the rates are the same. But the cards are not the same.

What Credit Score is Needed for Cerulean Credit Card?

To apply for this card you don’t need any credit score. You will get cash back and you can build a good credit. You can build the credit line and you have to make a refundable deposit of $200.

How Long Will It Take to Get the Cerulean Credit Card?

After you are approved for the credit card, you will get the card in main within 3 business days.

What Bank Issues Cerulean Credit Card?

Bank of Missouri. This is for people who have poor credit scores.

Will Cerulean Credit Card Offer Credit Limit Increase?

You will get six months of credit limit increase once you become a cardholder. You can also request the same by calling on (866) 449-4514. Also, to get a high chance of credit limit increase, you have to pay the bill on time for at least six months.

Conclusion

Cerulean credit card is useful for poor credit people. You can build your credit history with this card. However, if you are having login trouble or any other technical problems contact the customer service team.

Reference Link