How to Apply for Mobiloans Line of Credit at mobiloans.com

Mobiloans is a flexible way to borrow cash. Through this article, we will provide the step-by-step procedure to apply for the Mobiloans Line of Credit. It offers the flexible payment options, no prepayment penalties or hidden fees and allows you to better manage your everyday expenses. In this article, you will get everything that you must know about the Mobiloans loans. So, please be sure to read this article till the end to know more about the Mobiloans.

What is Mobiloans

Mobiloans markets its loans to individuals who want emergency cash. It is important for the potential borrowers to know that Mobiloans is a tribal lander that is not subject to state laws. This company is owned by the Tunica Biloxi Tribe of Louisiana, federally recognized as an American Indian tribe back in 1981. Mobiloans conducts its business online out of an office situated on the tribe’s reservation.

Mobiloans loans are mostly similar to the credit card advantages, although they have higher interest rates that are more in line with a payday loan. In addition to cash advance fees and finance charges, it charges the customers with an APR between 206.14% and 442.31%.

Typical Loan Terms of Mobiloans

The loans offered by the Mobiloans are actually the line of credit. If you approved for a certain amount, for example $2,000, but aren’t charged until they actually draw from the approved amount. You can opt to withdraw $200 from the $2,000 or the whole $2,000. Just like other typical loans, they will also perform a credit check on all applicants.

These are some specific terms you will get when taking out a loan with Mobiloans:

- You can borrow the amount between $200 to $2,500

- Weekly, bi-weekly, semi-monthly, and monthly repayment plans available

- Interest range between 206.14% to 442.31%

- Cash advance fees is range between $30 to $125

How to Apply for Mobiloans Line of Credit – mobiloans.com/apply

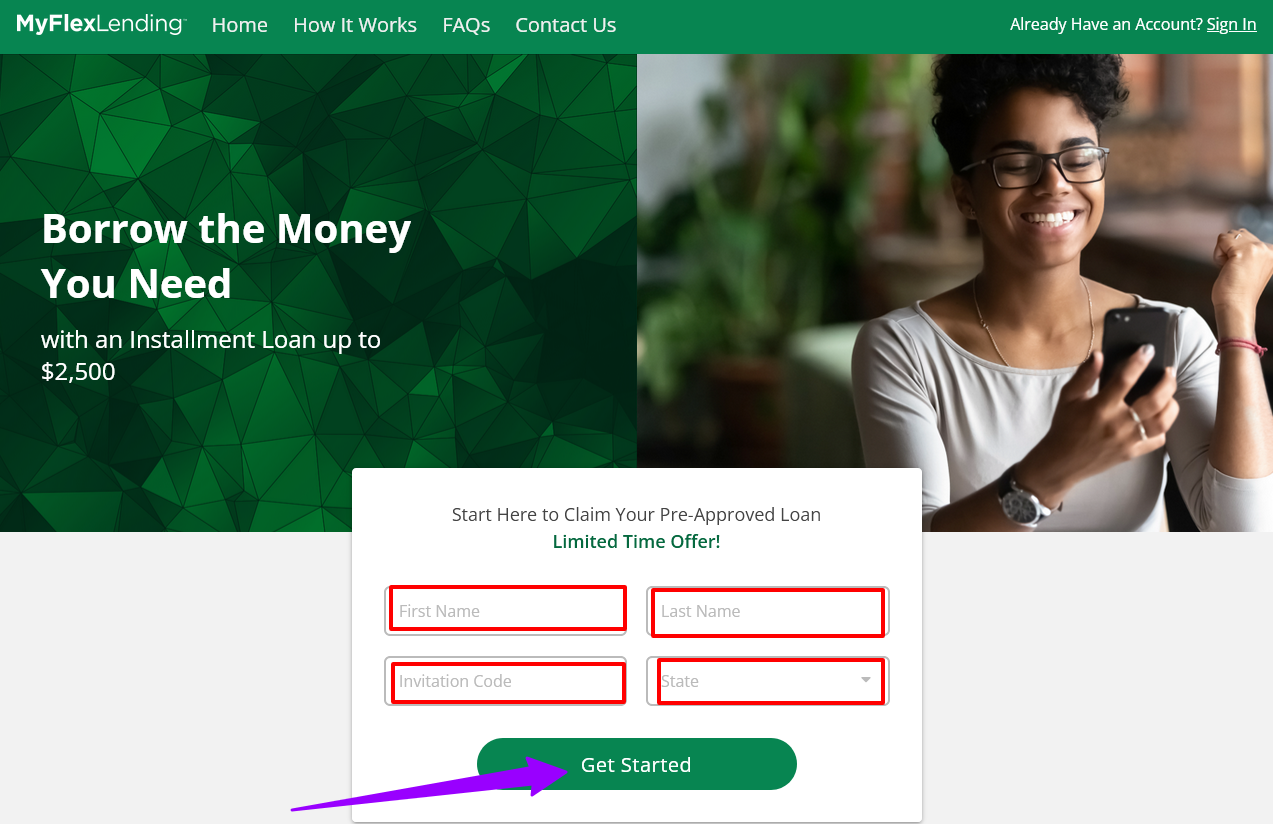

If you are intersected in applying for the Mobiloans, then you have to visit to this link mobiloans.com/apply. Then you will find that there are just four simple steps to applying for a loan:

- Create your account: You have to select your state from the drop down menu and create your login credentials. You will need to provide your name and date of birth in this stage.

- Provide your personal information: Now, you have to add your physical address, social security number, and driver’s license number in the given fields.

- Provide your financial information: Provide your details about your employment, as well as information for one of your bank accounts. That bank account must allow for auto withdrawals, as this is how your loan will be repaid.

- Submit the application: It will take just a few minutes to review the information you entered in the application to ensure that it is correct. Make sure to fix any errors and submit the application for review.

Pros and Cons of Mobiloans Loan

Pros:

- The application procedure is quick and very simple

- Get the funds as soon as the next business day

- Statements and email notifications to remind your next due date

- Get the online loan cost and fees calculator in the FAQs section in the website

- You can participate in Mobiloans Rewards, that allows the borrowers to earn between 10% and 65% off their cash advance fees and fixed finance charges

Cons:

- Mobiloans does not serve a total 21 states or the District of Columbia

- The interest rates are extremely high

- Complex fee structure, which might be difficult to understand for the borrowers

- The customer service team are not that responsive

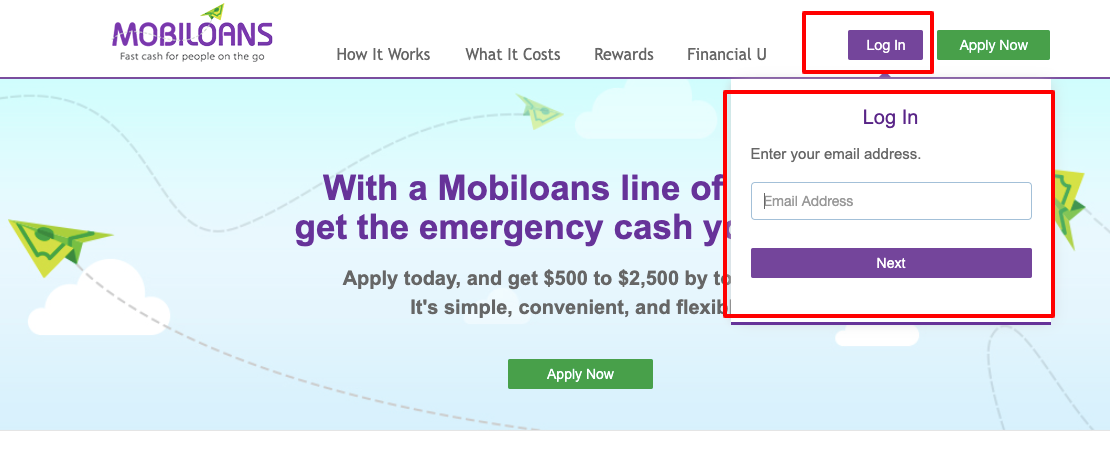

How to Access the Mobiloans Login Portal

In order to manage the Mobiloans Line of Credit, you must have to login to your loan account. You just have to follow these simple instructions below to access your Mobiloans loan account:

- You have to visit to this link mobiloans.com.

- Then, from the top right-hand corner of the Mobiloans homepage, click on “Log In” option.

- You have to enter your Email Address on the given field and select the “Next”.

- On the next step, provide your password to access the Mobiloans account.

How to Make the Repayment for Mobiloans

You have the option to set up AutoPay via Mobiloans.com with your checking account. Your payment amount will automatically be deducted from your account on the due date. Also, you have the option to send your payment stub through the money order or check.

Within a month from the date of your first draw on your Mobiloans Line of Credit, your first payment will be due. Your pay frequency will depend on how often you make payments. Your subsequent payments will be due on every 14 to 17 days. It does not matter what frequency you pay; all the customers must make at least 2 minimum monthly payments.

Mobiloans Customer Service

If you have any queries about the Mobiloans, then you can contact with the customer service department. To reach the Mobiloans Customer Service department, you can use these following details:

Phone Number:

Customer Support: 877-836-1518

General Fax: 877-891-7862

Customer Support Hours:

Automated customer support is available 24/7

Live customer support is available:

7:00 AM to 7:00 PM CT, Monday – Friday

7:00 AM to 3:00 PM CT, Saturday

Mailing Address:

MobiLoans, LLC

P.O. Box 1409

Marksville, LA 71351

Physical Address:

MobiLoans, LLC

151 Melacon Drive

Marksville, LA 71351

FAQs about Mobiloans

What is my Pay Frequency?

Pay Frequency means the frequency you will receive your income payments which could be either weekly, bi weekly, semi-monthly, or monthly. If your Pay Frequency is weekly, then your Pay Dates are considered to be the bi-weekly for determining the Billing Cycle under this agreement. All the pay frequencies are needed to make two minimum amount due payments every month.

What is Financial U?

Financial U is an online learning platform that teaches the basic financial concepts and provides helpful tips for creating healthy financial habits. You can access the online courses, interactive tools, and other free resources only for the Mobiloans customers. You can even get the rewards for successfully graduating from Financial U! Rewards are subject to eligibility requirements.

What are Mobiloans Points?

The Mobiloans Rewards program lets you to receive Points by participating in several activities and performing specific transactions with your Mobiloans Credit Account, such as timely and successfully making your minimum due payments. Once you accumulate Points, you will get the Reward Discounts that will redirect the standard cash advance fees and fixed finance charges on your Mobiloans cash advances.

What states are currently NOT serviced by Mobiloans?

Arizona, Arkansas, Colorado, Connecticut, District of Columbia, Georgia, Illinois, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Montana, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, South Dakota, Vermont, Virginia and West Virginia.

How much money can I get?

Yes, you will get the available credit by logging on to your Mobiloans account. The credit limit represents the credit they have agreed to extend to you. The available credit is the maximum amount that may be requested as an advance at any time.

Conclusion

So, this is all for this article about the Mobiloans Apply – mobiloans.com/apply. Through this article, we have tried to provide you the step-by-step procedure to apply for the Mobiloans Line of Credit. Along with these, we have tried to cover all the other details that you must know about the Mobiloans. But still if you have any queries or face any issue, contact with the Mobiloans Customer Service department.

Explore More

- How to Apply for Prosper Personal Loan

- How to Apply for MyFlexLending Loan

- LoanDepot Loan Administration Login

- Apply for Upstart Personal Loan

- Apply for Discover Personal Loan

- Myinstantoffer Loan By LendingClub

- Sba Loan Login

- Apply Rise Credit Loans