TurboTax Login Guide at turbotax.intuit.com

TurboTax Login-Create and Sign into TurboTax Account

Tax returns are not that easy to prepare. And for the complications, people tend to hire tax professionals to prepare their files. But what if you want to do it yourself? The task at first may seem exhausting, but if you use TurboTax, you can avoid the hassles easily. TurboTax is a genuine tax preparation software that will help you with your tax returns with just some clicks. With this software, you can get rid of difficult calculations, and you will get automatic tax filing. TurboTax offers different types of versions, and you have to select the one that meets your requirements. In this article let’s know about the TurboTax login and much more.

There are various versions of TurboTax, and while choosing one you may get confused, and end up selecting the one that you don’t need. If you end up buying the deluxe version, but later understand that this is not what you were looking for. You may want to start over on TurboTax. And there are some ways you can start over.

What is Turbotax

TurboTax is a software that transfers the W-2 tax form information into a tax return for millions of customers. The software is made to save time and the complications of tax returns. TurboTax also searches 350 tax deductions and credits to find better tax refunds and benefits for taxpayers. While using the program, you will get step-wise help for tax returns. You will get several versions such as TurboTax Premier Home and Business, TurboTax Deluxe, and many more.

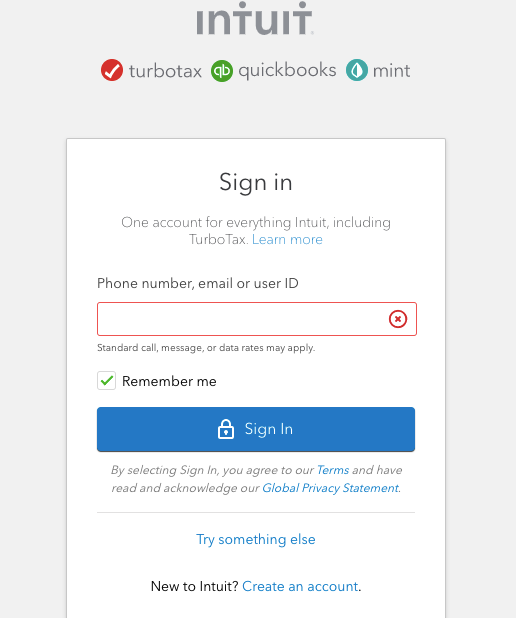

TurboTax Login Steps

To log in to your TurboTax account you need to go through the official webpage myturbotax.intuit.com. Once you arrive on the page, you need to follow the steps by step TurboTax login process:

- Go to the official URL turbotax.intuit.com

- Or directly go to this link myturbotax.intuit.com

- Next, at the center of the page add your registered phone number, user ID, email

- Now click on the ‘Sign in’ button.

How to Reset Turbotax Login Details

It can happen that you forgot the login details of TurboTax. But don’t worry, we are here to help you out with the login details reset process. Let’s take a look:

- Visit the web address myturbotax.intuit.com

- Secondly, under the login section click on the “try something else” tab.

- Enter your last name, date of birth, social security number and zip code.

- Click on the “Continue” button.

- Now, follow the page instructions after this to reset your TurboTax account details.

Create TurboTax Account:

To get a hassle-free login you need to create an account first. Check out the account creation steps below:

- To create turbotax account open the webpage turbotax.intuit.com

- Next, under the login button hit one ‘New to Intuit? Create an account’ button.

- Add your email, confirm email, user ID, phone number, password

- Now click on ‘Create account’ button.

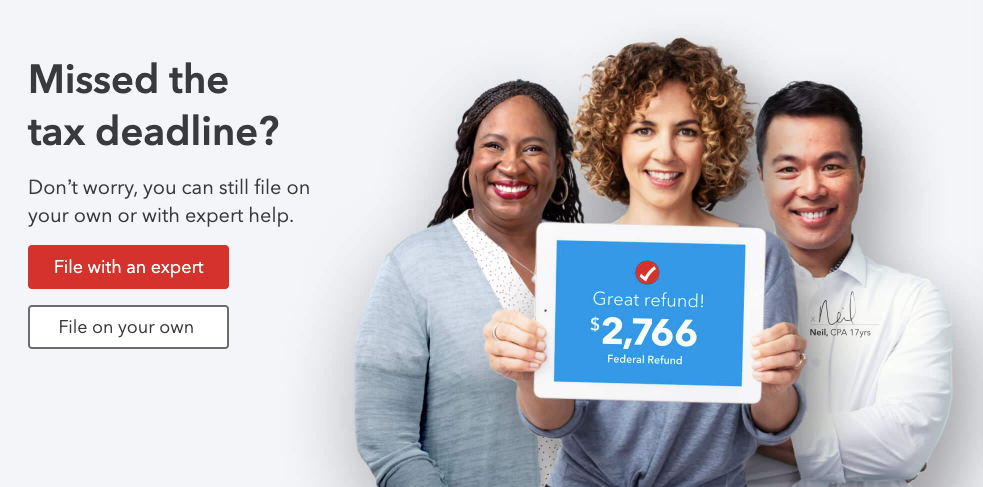

File Tax Returns with TurboTax Expert

To file your tax returns you will get various helps from TurboTax website. You can either use the desktop site, or the download the app on your mobile, to get the task on go. At first, we will talk about the filing tax returns with experts. Let’s take a look at the below steps:

- To file you have to use the URL turbotax.intuit.com

- Next, at top left side of the page click on ‘File with an expert’ button.

- From the drop down menu click on “Two ways to file with tax experts” button.

- After that, you will get options of turboax live and turbotax full service.

- You will get the live service for free, and for the full service you will have to pay the required fees.

- Choose the one you need and follow the page instructions.

You May Also Like

Hobby Lobby Employee Login Portal

How to File Taxes On Your Own at TurboTax

You will also get the option of filing the taxes on your own. Check out the below steps:

- To file on your own go to the webpage turbotax.intuit.com

- Next, at the top left side of the screen click on ‘File your own taxes’ button.

- You will get a drop-down menu and there click on “About doing your own taxes” button.

- You will get the “Start for free” tab at the middle of the page.

- Once you click on it, there will be various options to choose from.

- Choose the one required and follow the page instructions.

How to Track Tax Refund from TurboTax:

If you have filed a tax return with TurboTax, you must check the refund you will get. To track this you need to follow the below steps:

- Go to the webpage turbotax.intuit.com/after-you-file

- Next on the center-left side of the page click on the “track my refund” tab.

- Check the option on the page and you have to follow the instructions.

Check E-File Status with TurboTax:

You can check your e-file status with TurboTax. Check out the process below:

- For this open your browser to visit the URL turbotax.intuit.com

- Next, at the upper right side of the page click on the “After you file” tab.

- From the drop down click on the “check your e-file status” button.

- Or directly go to this link turbotax.intuit.com/tax-tools/efile-status-lookup/

- After this, you will be asked to log in with the TurboTax online account and login to your TurboTax account to check your e-file status

If you did not file your tax with Turbotax then you can check your status and refund on the IRS website www.irs.gov/refunds

How to Pay TurboTax Online Fees

- Open the website turbotax.intuit.com on your browser

- Next, you have to log in to your account using the right credentials.

- After this, you can check your orders, and look for the fee payment options.

- You can make the payment using your credit or debit card also, you can pay with a federal refund.

TurboTax Contact Support:

If you are facing some trouble while login into the TurboTax account, you have to contact the customer service team. Once you call them, the team will help you resolve the problem.

Let’s take a look at the contact numbers:

- Contact Number: 1-800-446-8848

- Contact Number: 1-605-450-6884

Frequently Asked Questions

Q: Why Is TurboTax Asking For Money From Me?

A: This is happening because you might be using the Deluxe version, and this is a paid service. If you are paying the fees with the federal refund, you may have to pay an extra $40 service charge.

Q: Can I Qualify for Free TurboTax?

A. If you are making a simple tax return, you may be eligible to get a free service.

Q: Which TurboTax Version is Perfect for Me?

A: If you have rental estates, or investments and stocks, you can go for the TurboTax Premier or Home & Business version. If you have a home business, you are a contractor or you are self-employed, then you need the TurboTax Home & Business version.

Conclusion:

TurboTax is an easy gateway for your tax returns. You will find the process to be very simple, and you will get maximized refunds as well. However, if you face any login or any other issues, you can get in touch with the TurboTax customer service team.

Reference Link:

turbotax.intuit.com/after-you-file