How to Check Pre-Approval for Discover Credit Card

If you wish to check if you are pre-approved for the Discover Credit Card, then this article is for you. Through this article, we are going to provide you with the step-by-step procedure to check the Discover Credit Card Pre-Approval. Here, we will also provide you with detailed information on how to access the Discover Credit Card Login, online account registration, password, reset guide, etc. So, keep reading this article till the end to check the Discover Credit Card Pre Approval.

About Discover

Discover Financial is an American financial company, operated by the Discover Bank. It was started in 1985 as a subsidiary of Sears, who was the founder of the company. The headquarter of the Discover Bank is located in Riverwoods, Illinois, United States. They offer savings accounts, personal accounts, home equity loans, student loans, and credit cards. Throughout the United States, Discover is considered to be the third-largest credit card brand.

What is the Meaning of Pre-Approved for a Credit Card

If you are lucky enough received a pre-approved or pre-qualified offer for the Discover Credit Card, then you may think it means you are automatically approved for the card. But, that’s not the case. Both of these refer to a screening process that checks whether you are likely to be approved when you apply for a credit card. When you are looking for a new credit card, then consider what it means to be pre-approved vs pre-qualified, and how to pre-screening process works.

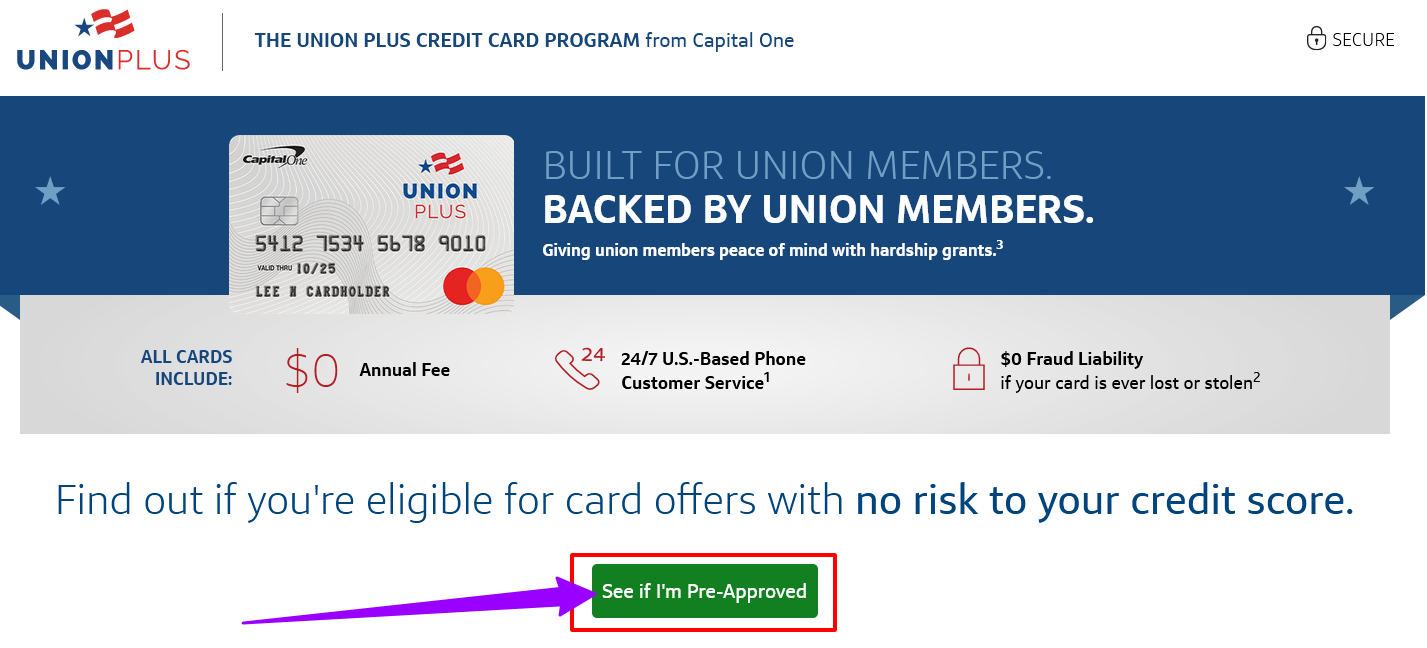

When you receive a pre-approved credit card offers, that usually means the card issuer has determined that you meet certain requirements after they run a soft credit check, without hurting your credit score. If you continue to meet the issuer’s credit standards and have sufficient income when you apply, your chances might be higher of getting approved.

Check If You Pre-Approval for Discover Credit Card or Not

If you are thinking of applying for the Discover Credit Card, then you should check if you are pre-approved for the card or not. You can easily check the Discover Credit Card Pre-Approval by following these simple instructions below:

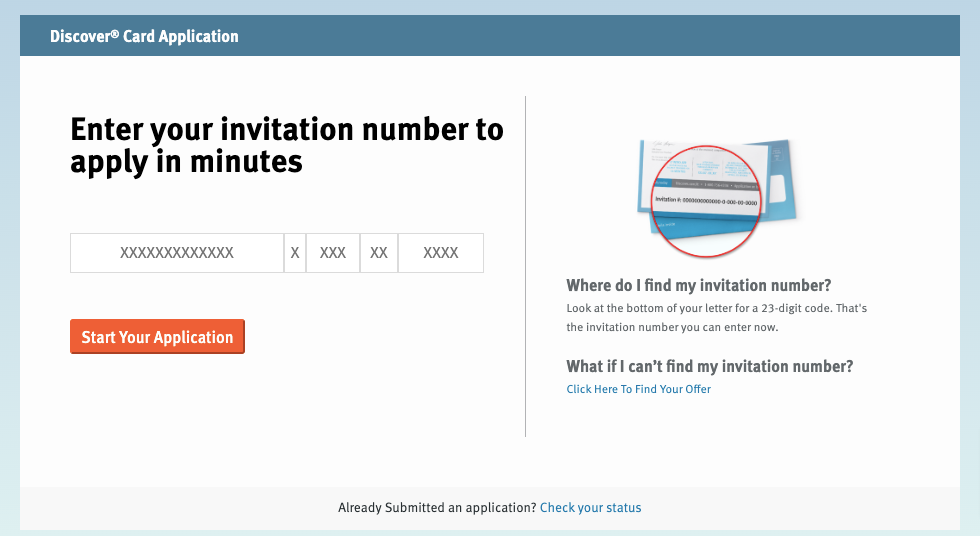

- You need to visit this link discover.com/preapprove.

- You have to provide your information such as your name, address, date of birth, your annual income, etc.

- After providing all the requested details on the given fields, you just need to select the “Check Now” option.

- Then, you can simply follow the on-screen guideline to check the Discover Credit Card Pre-Approval.

Some of the Best Credit Cards offered by Discover

Discover Credit Cards are well known for offering generous rewards, no foreign transaction fees, 0% introductory APRs, and offers for applicants of all credit levels. Here are some of the best credit cards offered by Discover:

Discover Cash Back

Discover Cash Back Card is a good option for people with a credit score of 700+ who want a $0 annual fee and a high cash back rewards rate. This credit card provides 5% cash back on your purchases in bonus categories up to a quarterly maximum, and Discover will match the rewards you earn the first year. However, the 5% bonus categories charge quarterly and need activation.

Discover Chrome

Discover Chrome is a one of the best cash-back rewards cards for individuals with good to better credit scores. This card mainly targets to those whose top expenses include gas and dining out. This credit card has a $0 annual fee and provides 2% cash back on the first $1,000 spent at gas stations and restaurants each quarter. Plus, the cardholders can earn 1% cash back on all other purchases. The Discover will double your earned rewards for the first year as an anniversary present.

Discover Secured Credit Card

Discover Secured Credit Card is one of the best-secured cards because it has a $0 annual fee and gives good rewards on purchases. This card is also worth it because it doubles the rewards for the first year. The minimum deposit for this credit card is $200, which is on the low end for a secured credit card, too.

How to Access the Discover Credit Card Login Portal – Step by Step

In order to manage your credit card, you must have to access the Discover Credit Card Login portal. You can follow these easy-to-follow instructions below to access your credit card account:

- You need to visit this link discover.com.

- Then, from the top right hand of the homepage, you will see the Discover Credit Card Login section.

- There, on the given spaces, you just need to input your registered User ID and Password.

- If you wish to save your User ID on that particular device, check the box, “Remember User ID”.

- After entering your registered login credentials on that device, select the “Log In” button.

How to Check the Discover Credit Card Application Status – Step by Step

If you already applied for the Discover Credit Card and now want to check the application status, then follow the instructions below:

- Firstly, you have to visit the official website of Discover at discover.com.

- There, right under the login section, you just need to select “Check Application Status” for next step.

- You have to provide your social security number and zip code on the given fields.

- After providing the requested details, you just need to select the “Continue” button to check the status.

FAQs about Discover Credit Card

How to receive pre-approved or pre-qualified credit card offers?

You may receive a pre-approved or pre-qualified credit card provided in the mail, or you can try applying online to be pre-approved or pre-qualified. The online form offers credit card issuers with some basic personal and financial details.

Should I still apply if I’m not pre-approved or pre-qualified for a credit card?

If you request a pre-approved provider online but are not provided with an offer, that means there is something in your credit history or other information you have provided in the pre-approval. You may also wish to obtain a copy of your credit report to check and address any issues before applying for the credit card. If there is any problem that is keeping you from being pre-qualified for a credit card, you can dispute them with the credit bureau.

How can I improve my chances of being pre-approved or pre-qualified?

If you don’t pre-qualify for a credit card, then you should work on improving your credit score so that you may be eligible for Pre-Approval offers. You can improve your credit scores by paying your bills on time every month. If you missed or have late payments, that can bring down your credit score and hurt your chances of pre-qualifying for a credit card. Also, if you use too much of your available credit card that can lower your scores.

Conclusion

So, that is all for this article regarding the Discover Credit Card Pre-Approval. Through this article, we have tried to cover all the important topics related to this matter. Hope, this article is beneficial for you and that it helped you a lot regarding this Discover Credit card.

Reference Link