www.marksandspencer.com – Marks and Spencer Card Login

Marks and Spencer Card Manage :

Marks and Spencer Group is a Public Limited Company, popularly abbreviated as M&S is a significant British Global Retailer organization. It has its headquarters located in London, England. The company generally specializes in selling garments, household items, and a variety of food products, under its own brand name. It is recorded on the London Stock Exchange and is a constituent of the FTSE 250 Index, also previously listed in the FTSE 100 Index from its formation till 2019.

M&S was established in 1884 by Mr. Michael Marks and Mr. Thomas Spencer in Leeds. M&S presently has 959 stores across the United Kingdom, including 615 outlets that specifically sell food items, and through its Television publicizing, declares the selective nature and extravagance of its food and drinks in the market. The organization additionally offers a digital platform for its food delivery services along with a joint business with Ocado.

The organization became the first British Retailer in the year 1998, to make a pre-tax profit of over £1 billion. In the last few years, its clothing sales have decreased and its food sales have gone high after discontinuing the St. Michael moniker for its own brand. Additionally, M&S also began to sell branded goods like Kellogg’s Corn Flakes in November 2008.

In the year 2018, Marks and Spencer (M&S) affirmed that more than 100 outlets will have shut by 2022 in a “revolutionary” plan. In August 2020, Marks and Spencer Group expressed that they were going to eliminate approx 7,000 job positions throughout the following few months due to the SARS –Covid19 pandemic situation.

The organization is a British value for money retailer, they had their own labeled business-like, Clothing, Food, and Home, within the United Kingdom and globally. Presently, they operate a family of businesses, selling superior grade, incredible worth own-branded items within the United Kingdom and along with 62 nations, from 1,519 stores and 44 online platforms universally.

How to Activate Marks and Spencer (M&S) Card:

If you want to Activate your Marks and Spencer (M&S) Credit Card, “Sign In” to your Digital Banking account and choose the “M&S Credit Card” from the “Accounts” section. Then after selecting the “Activate my Credit Card” option, from the left-hand side navigation section and follow the simple instructions to complete.

In case if you have not registered for Online Banking till now, you can still activate your Marks and Spencer (M&S) Credit Card by calling Customer Care Services at 0800 -015 -0044 you have to provide answers to few personal data and follow the process to activate your Credit Card.

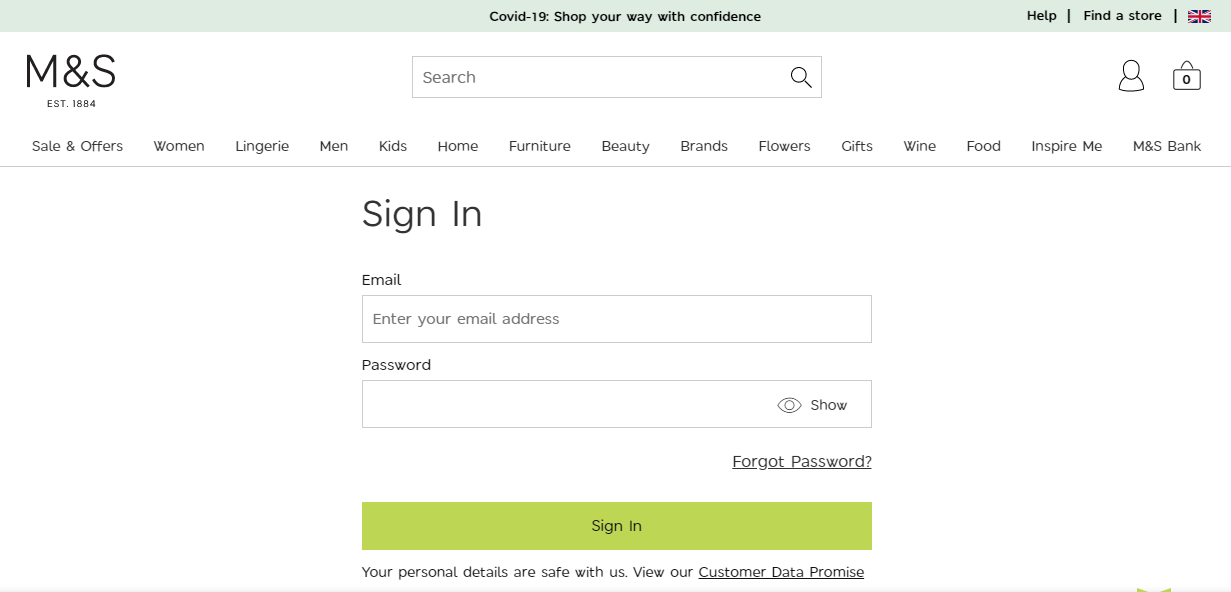

How to Sign In for the Marks and Spencer Card :

To Sign In for the Marks and Spencer (M&S) Credit Card, follow the below guidelines:

- Visit the main official website of Marks and Spencer (M&S).

- You can also click on the link provided www.marksandspencer.com.

- On the landing page, you will find and tap on the “SIGN IN”

- Now on the SIGN IN heading page, put your “Email Address” and “Password”.

- Then tap on the “Sign In” bar below, to get into your account.

How to get Registered for the Marks and Spencer Credit Card :

To get Registered for the Marks and Spencer (M&S) Credit Card, go with the instructions below:

- Go to the SIGN IN heading page, following the Sign In process above mentioned.

- Here you will find the “Register” link, click on the option.

- On the “Let’s Get Started” page, put down your “Email Address”.

- Lastly, click on the “Continue” tab below to finish.

Eligibility to Apply for a Marks and Spencer Card:

- You should be a resident of the United Kingdom, aged 18 or older with a regular annual income.

- You must have a Pension or Annual Income of at least £6,800.

- Within the last 30 days, you have not been declined for an M&S Credit Card.

- You should be happy for M&S to undertake a Credit Scoring search and Credit Register.

- Within the past 12 months, you should have not held an M&S Credit Card.

How to Apply for a Marks and Spencer Card

To Apply for the Mark and Spencer Credit Card, go with the steps:

- Go to the main website of Mark and Spencer.

- On the Home page, find out the M&S Bank option.

- Now on the M&S Bank Credit Card page, you will find the “Apply Now”

Also Read : Shell Credit Card Account Login

All About Marks and Spencer (M&S) Credit Card Reward Plus:

Benefits and Advantages:

- With the Marks and Spencer (M&S) Credit Card Reward Plus offer, enjoy up to £20 spending at M&S online or in-store.

- You can double your M&S Reward Points on all your M&S shopping for 12 months.

- You can earn 2 (two) Marks and Spencer (M&S) Reward Points for every £1 of your spending at M&S, within the first year and 1 (one) Reward Point for every £5 you spend elsewhere.

- Avail the advantage of receiving 500 M&S Reward Points vouchers worth £5, and then an additional £15 E-Gift Card, as you spend a minimum amount of £50 on your Credit Card.

- With a £500 limit, you can start your shopping straightaway at M&S.com or in any M&S store.

- Get the benefit of a 0% Purchase Offer as you shop using your M&S Credit Card in 43 million outlets globally, anywhere you find the Master Card logo, and you don’t have to pay a penny of interest for the first 6 months.

- You can manage and track your Marks and Spencer (M&S) Credit Card, anytime through Internet Banking and the M&S Banking Application at your own convenience.

- You can get the advantage of a 0% Balance Transfer offer, in case you take out a new M&S Credit Card today, you have to pay No Interest for 6 (six) months on the Transfer of Balances made within 90 days from the date of account opening. Afterward, a 2.9% fee is applied, for transferring a minimum amount of £5.

- Digital Safety and Security is the primary focus of Marks and Spencer (M&S) technical security systems, which permits you to utilize your M&S Credit Card with confidence, whenever and wherever you shop.

- Utilize your M&S Credit Card along with your Sparks Card, together when you shop at M&S outlets or on the online platform, and can earn even more rewards.

Rates and Interests:

- Purchase Rate Interest (variable) – The charges are 19.9% per annum.

- Interest for Representative Annual Percentage Rate – The charges are 19.9% APR (Variable).

- Assumed Credit Limit – You can get up to £1,200 depending on your Credit limit.

- Fees for Purchase and Cash or Cash Related Payment – The charges are 2.99% of the transaction in Sterling (Minimum charge for Cash or Cash related payment £3).

- Charges for Late Payment – The charges are £12 Up to 4 days after the date you should have made the payment.

- Fees for Surpassing the Credit Limit (Even if M&S permits it) – When you go over the Credit Limit, the charges are £12.

- Charges for Payments which are Returned Unpaid – When your bank informs M&S that it can’t make the payment, the charge is £12.

Contact Details:

If you need to update your contact details, ask for information, tell us that you want to withdraw from the agreement or make a complaint please: Write to,

Marks & Spencer Financial Services plc,

PO Box 3848, Chester CH1 9FJ

OR,

M&S Bank

PO Box – 10565

51, Saffron Road,

Wigston, LE18 9FT

Phone Numbers:

(M&S) Customer Care Services (Call): 0345 900 0900 and 0345 -600 -5860 (8 am to 8 pm)

To Activate Marks and Spencer (M&S) Credit Card (Call): 0800 -015 -0044

To Report Lost or Stolen Card (Call): 0800 -085 -2411 (For United States) (24X7)

To Report Lost or Stolen Card (Call): +44 -(0) -1244 -879080 (For Outside United States)

Card Security Team (Call): 0345 -602 -0568

Reference Link:

bank.marksandspencer.com/help/card-support/activating-your-card